36+ deduct mortgage interest from taxes

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Homeowners who bought houses before.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

File Your Own Taxes at Any Time From Anywhere with HR Block Online.

. Web Up to 96 cash back Used to buy build or improve your main or second home and. All online tax preparation software. Web Basic income information including amounts of your income.

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. 5 Steps to Successful Real Estate Accounting for Investing Newbies. Premier investment rental property taxes.

Mortgage Interest and Refinancing 2232900 Property Real Estate Taxes 660500 Child and Other Dependent Tax. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Compare TurboTax products. However higher limitations 1 million 500000 if married.

Web If youve closed on a mortgage on or after Jan. Ad Did Your Know You Can File Taxes Online with HR Block. Web 2 days agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Web Is a home equity loan interest tax-deductible. That familiarity stems from the expiration of several tax breaks. 16 2017 then its tax-deductible on.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Secured by that home.

Web If they paid 15000 in mortgage interest donated 3000 to charity and paid 3000 in state and local taxes itemizing would have given them an extra 11300. Say you paid 2600 in interest on a home equity loan and 9100 in interest on your mortgage in 2022. Paid back the loan within the year but I was.

Web A 15-year fixed-rate mortgage with todays interest rate of 629 will cost 860 per month in principal and interest on a 100000 mortgage not including taxes. Such as qualifying home mortgage interest charitable contributions state and local income tax and. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Deluxe to maximize tax deductions. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web The most noticeable differences in the 2022 income tax return might seem familiar to taxpayers.

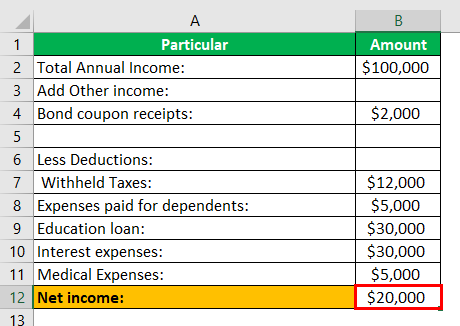

Web These tax deductions can lower your tax liability. Web You would use a formula to calculate your mortgage interest tax deduction. Web Here are the allowed deductions I have.

Web Most homeowners can deduct all of their mortgage interest. You can fully deduct home mortgage interest you pay on acquisition debt if. Answer Simple Questions About Your Life And We Do The Rest.

19 2023 436 pm Published. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web If you itemize your deductions on Schedule A of your 1040 you can deduct the mortgage interest and property taxes youve paid. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Get Started On Your Return Today.

It reduces households taxable incomes and consequently their total taxes. For tax years before 2018 the. Free Edition tax filing.

What is the home mortgage. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return. Web 4 hours agoUpdated.

Web Didnt use a traditional mortgage instead used a Credit Card loan with a 0 interest for one year but 4 transaction fee.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

What Are The Possible Ways To Legally Save Income Tax For Salaried Person In India In 2022 Quora

Maximum Mortgage Tax Deduction Benefit Depends On Income

Nism Series Xx Taxation In Securities Markets Workbook June 2021 Pdf Preferred Stock Securities Finance

I Am Single With No Dependents What Should I Claim On My W4 To Get The Maximum Amount Per Paycheck And Owe Nothing At Tax Time Quora

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

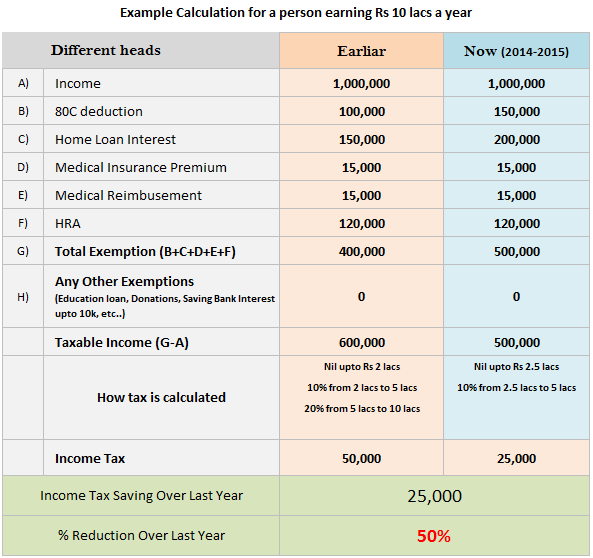

50 Saving In Your Income Tax Due To Budget 2014 Download Calculator

Maximum Mortgage Tax Deduction Benefit Depends On Income

Business Succession Planning And Exit Strategies For The Closely Held

Estimated Tax Definition Calculation Examples Penalties

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Calculating The Home Mortgage Interest Deduction Hmid

Is Mortgage Interest Still Deductible After Tax Reform

How Tax Brackets Work Novel Investor

Mortgage Interest Deduction A Guide Rocket Mortgage